Facts are stubborn things; and whatever may be our wishes, our inclinations, or the dictates of our passions, they cannot alter the state of facts and evidence. – John Adams

Deeply rooted in the realistic assessment of human nature, Adam Smith, the author of the infamous blueprint for capitalism, The Wealth of Nations (1776), argues for free trade among individuals – globally.

In Book III, Chapter Two, titled “Restraints Upon the Importation from Foreign Countries of Such Goods as can be Produced at Home”, he lays out the concept of cause and effect with protectionist prohibitions and restraints to free trade. The following excerpts are reduced to modern language for the reader.

“Prohibitions by high duties and tariffs promotes a monopoly to the domestic producers.” The objective is to secure any advantage to the producer in reducing competition, therefore securing the highest return on capital. Advantage – the producer; disadvantage – the consumer. The consumer, at any level of transaction, is denied the opportunity to benefit from reduced cost of goods.

Smith goes on to justify, on certain terms, prudence to buy any commodity or produce at a lesser cost due to Natural Advantage. The best example is bananas – better to buy them from tropical regions in Central and South America, than Canada. Coffee, wine, vegetables, diamonds, require certain climatic conditions to offer the consumer advantages in quality and cost.

Comparative advantages from one country to the other offer reduced cost by efficiency. South Korea can produce more smart phones at a lower cost than New Zealand through specialization and population. The United States can produce more printed books at a lower cost than Australia, and Brazil, who produces the most coffee beans than any other country in the world, and has for the past 150 years, at a lower cost. Would it not be prudent to purchase these products from these locations?

The cost benefit of Economies of Scale offered through large capital investments in computer automated equipment supported by a large population of educated and trained personnel do produce large quantities of product at a lower cost than antiquated manual systems. A highly efficient level of output benefits both the producer with higher profits and the consumer with lower cost.

Thomas Sowell, Ph. D., a renowned American economist educated at Harvard, Columbia, and University of Chicago, authored countless books and articles in economics and other issues concerning religion, politics, and health care, to name a few.

In his recent publication, Basic Economics Copyright 2015, he makes a clear and concise argument for the benefits of free trade, echoing the same arguments in modern context to Adam Smith’s treatise on Economics. Chapter 21, International Trade, simply lays out the concept and gives definitive support to the benefits of free trade and the fallacies of most arguments for protectionism.

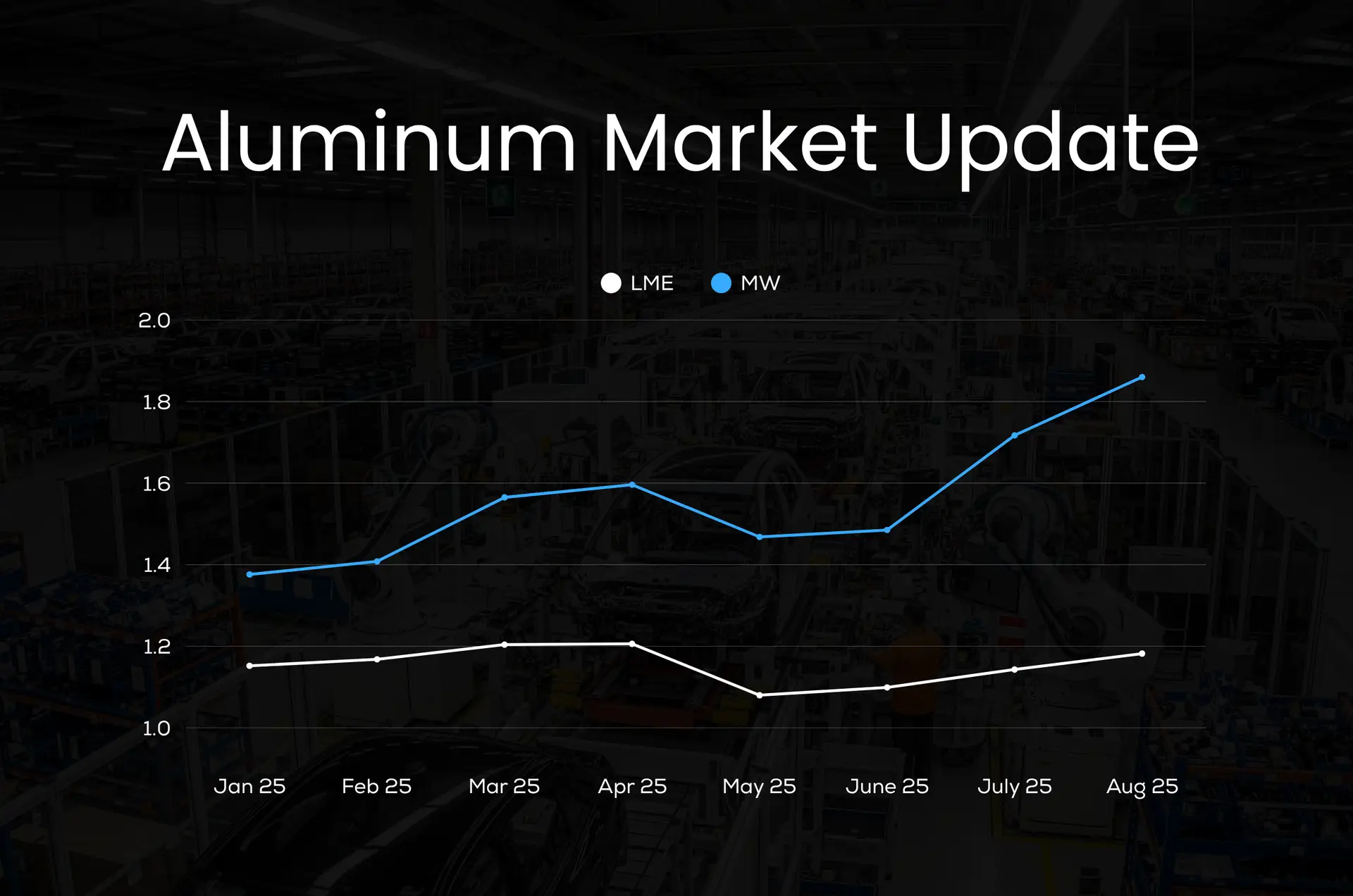

A current example – on October 4, 2023, a group of domestic aluminum extruders filed anti-dumping and countervailing duty petitions with the U.S. Department of Commerce against 15 countries. The combined exports to the US was reported by the Commerce Department to be $2.8 billion USD in 2022. According to Grand View Research, the US Aluminum Extrusion market in 2023 is estimated at $6.78 billion USD. US based extruder’s supply 59% of total demand – a commanding market lead versus 41% from offshore suppliers.

The petitioner’s claim is all 15 countries are using unfair trade practices, or dumping its products on the market at prices below their cost of production. This is absurd on its premise alone. Many of these producers, in developed and developing nations have been producing aluminum extrusions at a profit for decades. No producer can survive by selling any product or service below their cost over an extended period.

This strategy is simply a protectionist tactic to reduce competition at the expense of the consumer. Domestic producers are losing customers to more efficient, lower cost producers – that’s capitalism. It’s easier for them to make unsubstantiated claims and rely on uninformed politicians and bureaucrats to raise tariffs on competitors than invest in improving efficiency. It’s their path of least resistance.

As Adam Smith called “this wretched spirit of monopoly”, we’ll all hope that the “Invisible Hand” metaphor he used to describe self- regulating systems that create economically optimal outcomes without government intervention, will truly balance free trade.

Larry S. Griffith

President