Supply Squeeze: Sanctions on Russian Aluminum Set to Impact Market

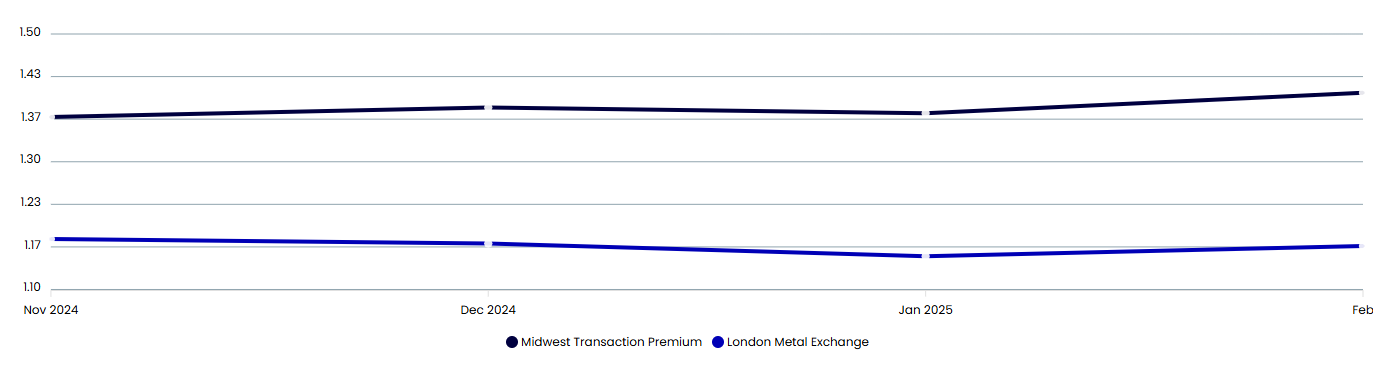

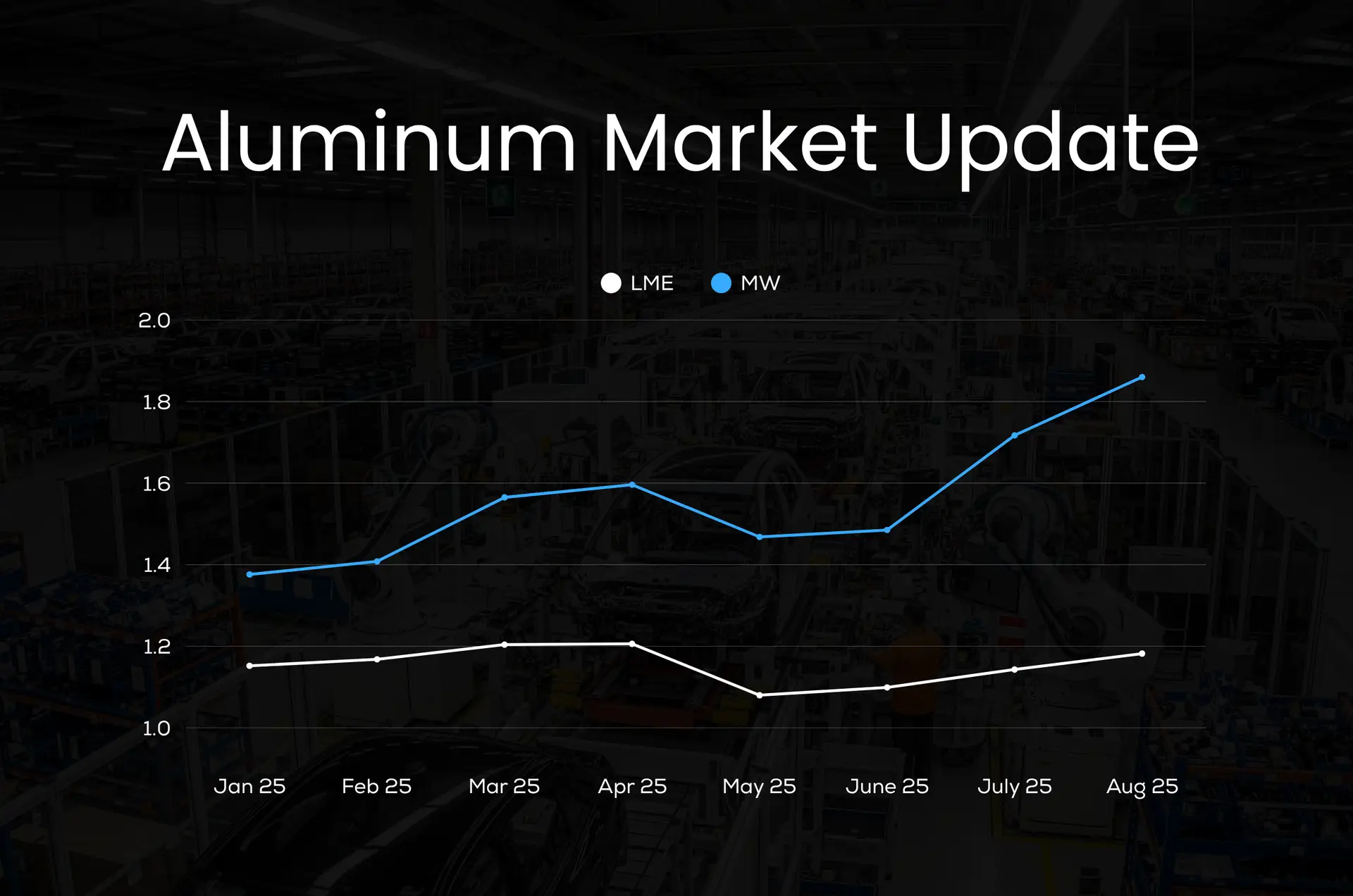

Aluminum futures rose to over $2,670 per metric ton ($1.211 LB), extending the

surge since hitting a four-month low of $2,490 on January 6th. The surge was supported by expectations of lower supply from key producers and respite for demand. The EU was set to sanction the import of primary aluminum from Russia in its upcoming package, reducing metal from the country as manufacturers have pivoted from buying Russian goods following its invasion of Ukraine in 2022.

China’s Production Cap: Record Highs but Output Slows

China produced a record-high 44 million tons of aluminum ingot in 2024, meaning that output will slow as Beijing capped output at the 45 million tons in 2017 to prevent excess supply. On the demand side, industrial output in China accelerated sharply in December.

Demand on the Rise: Industrial Output in China Accelerates

Aluminum increased 138 USD/Ton or 5.41% since the beginning of 2025, and forecasted to trade at 2599.70 USD/Ton ($1.18/Lb.) by the end of this quarter, according to Trading Economics global macro models and analysts’ expectations. Looking forward, we estimate it to trade at 2733.67 ($1.24/Lb.) in 12 months’ time.

Trading Economics January 20, 2025