The global aluminum market is currently experiencing a period of steady growth driven by increasing demand across various market sectors.

Current Market Conditions:

- Strong Demand: The demand for aluminum is being significantly boosted by the automotive industry’s shift towards lighter vehicles, especially electric vehicles (EVs), to improve fuel efficiency and reduce emissions. The construction sector in rapidly urbanizing regions, particularly in Asia-Pacific, is also a major consumer of aluminum for Building Products.

- Asia-Pacific Dominance: China is the dominant player, accounting for over half of the world’s primary aluminum production.

- Growth Forecast: Market analysts predict a continued growth trajectory for the aluminum market in the coming years, estimated to be around 5-6% between 2024 and 2030, with the global market size projected to reach approximately $267 – $307 billion by 2030.

- Sustainability Focus: Recycling is cost-effective and significantly lower energy consumption compared to primary production. Many primary producers are now diversifying into recycling to meet this demand and align with sustainability goals. This suggests scrap prices will increase exponentially.

Aluminum Pricing:

- Supply and Demand Dynamics: Increased demand from key sectors like automotive and construction generally puts upward pressure on prices. Supply disruptions or increases in production can also affect price levels.

- Energy Costs: The production of primary aluminum is an energy-intensive process. Fluctuations in energy prices, particularly electricity, directly impact aluminum production costs and, consequently, its market price.

- Raw Material Costs: The price of bauxite, the primary ore used to produce aluminum.

- Economic Conditions: Global economic growth or downturns affect industrial activity and, consequently, the demand for aluminum.

- Trade Policies and Tariffs: Trade disputes and the imposition of tariffs on aluminum imports can create price volatility.

- Currency Fluctuations: As aluminum is traded globally, exchange rate fluctuations can affect prices.

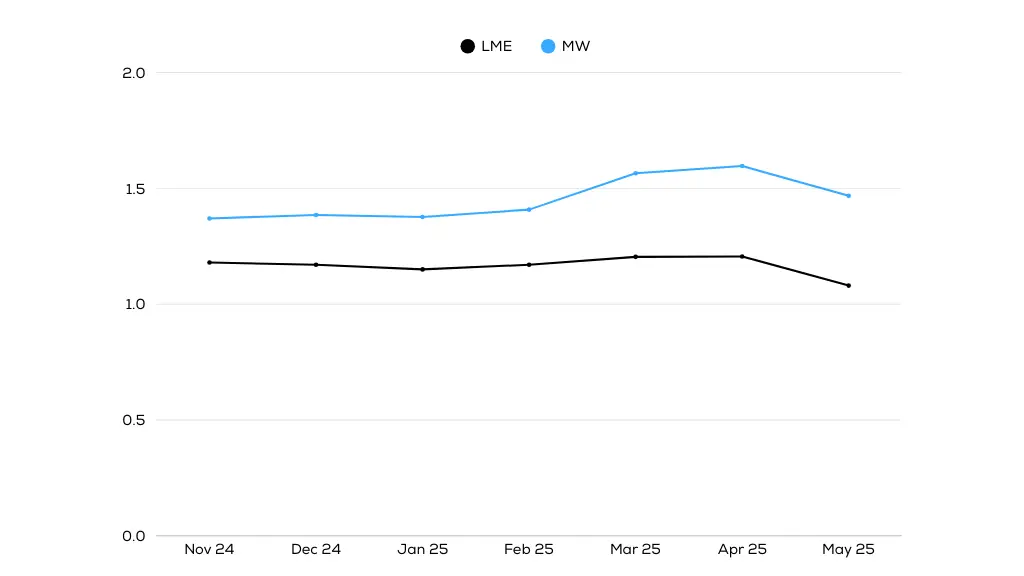

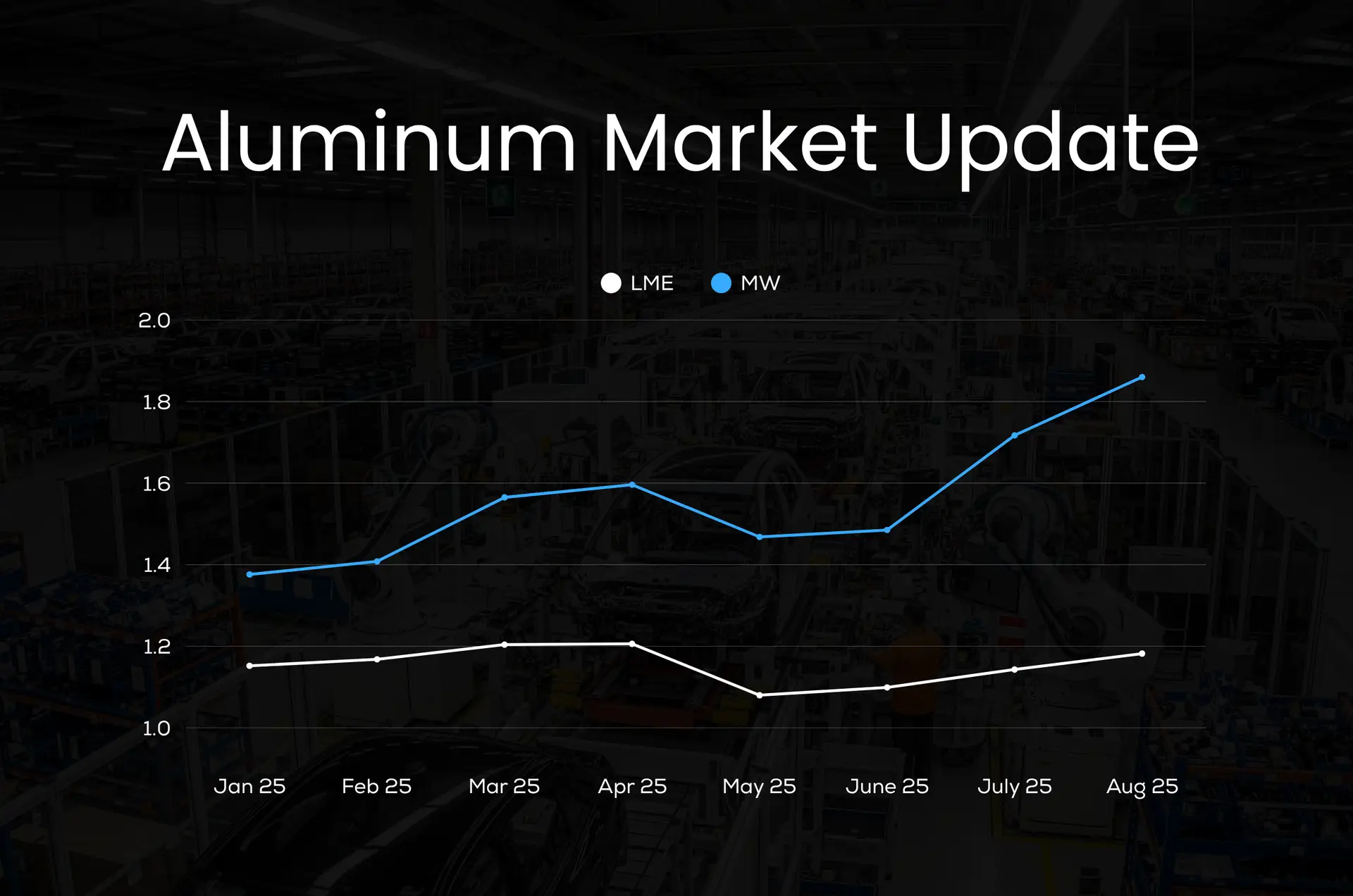

Recent Price Trends:

As of late April 2025, aluminum prices show an increase compared to the previous year.

- The Aluminum Spot Price (LME, CIF UK ports) in February 2025 was around $165.55 per metric ton, up by approximately 21.85% from February 2024.

- Another benchmark, the Aluminum Price (Commodity Markets Review), reached $2658.29 per metric ton in March 2025, showing an increase of about 19.41% from March 2024.

- The Global price of Aluminum was recorded at $2,651.60 per metric ton in March 2025.

These figures indicate a generally upward trend in aluminum prices over the past year.

Regional Price Variations:

Aluminum prices can also vary across different regions. For instance, in early 2025, price indices showed variations across regions:

- North America: Approximately $2.67 per kilogram or $1.21/lb. USD.

- Europe: Approximately $2.55 per kilogram or $1.16/lb. USD (showing a slight decrease).

- Northeast Asia: Approximately $2.79 per kilogram or $1.266/lb. USD.